Document onboarding startup Flatfile nabs $50M from investors • TechCrunch

[ad_1]

Data cleansing — prepping data for applications like predictive analytics — takes time. In fact, data scientists spend an estimated 60% of their time cleaning and organizing data, according to one recent survey. It’s not just time that’s lost. According to Experian, “dirty data” costs the average business 15% to 25% of their revenue and the U.S. economy $3 trillion annually.

On a mission to change things, Eric Crane and David Boskovic started Flatfile, a platform that automatically learns how imported data should be structured and cleaned. With customers like ClickUp, Square, AstraZeneca and Spotify, the startup is gearing up for its next growth phase, closing a $50 million Series B round that brings Flatfile’s total to $94.7 million.

Tiger Global led the Series B tranche with participation from GV (Google’s AI-focused fund) and Workday — the last of which no doubt saw the applicability of Flatfile’s data processing pipeline to its HR business. Scale Ventures and angel investors from Airtable, DocuSign, LinkedIn and Gainsight also contributed, Boskovic told TechCrunch in an email.

“Data exchange and onboarding the data of new customers in particular can take thousands of hours to complete as data is collected, cleaned and moved from one business to another,” Boskovic said. “Examples of this include clients sending bulk payments to a credit card company, or vendors sending supply chain updates to a food conglomerate. For large companies, data exchange can mean upwards of six months to prepare data causing delayed customer onboarding, cost overruns and lost clients … We envisioned a way to streamline the data exchange process to save them vast amounts of time and money.”

Crane and Boskovic created the tech behind Flatfile while at productivity startup Envoy, where they shared a mutual frustration with the many wasted hours spent manipulating and cleaning up the firm’s data. Through Flatfile, they sought specifically to address challenges in data onboarding, where the high variance across input files has historically made rule-based models ineffective.

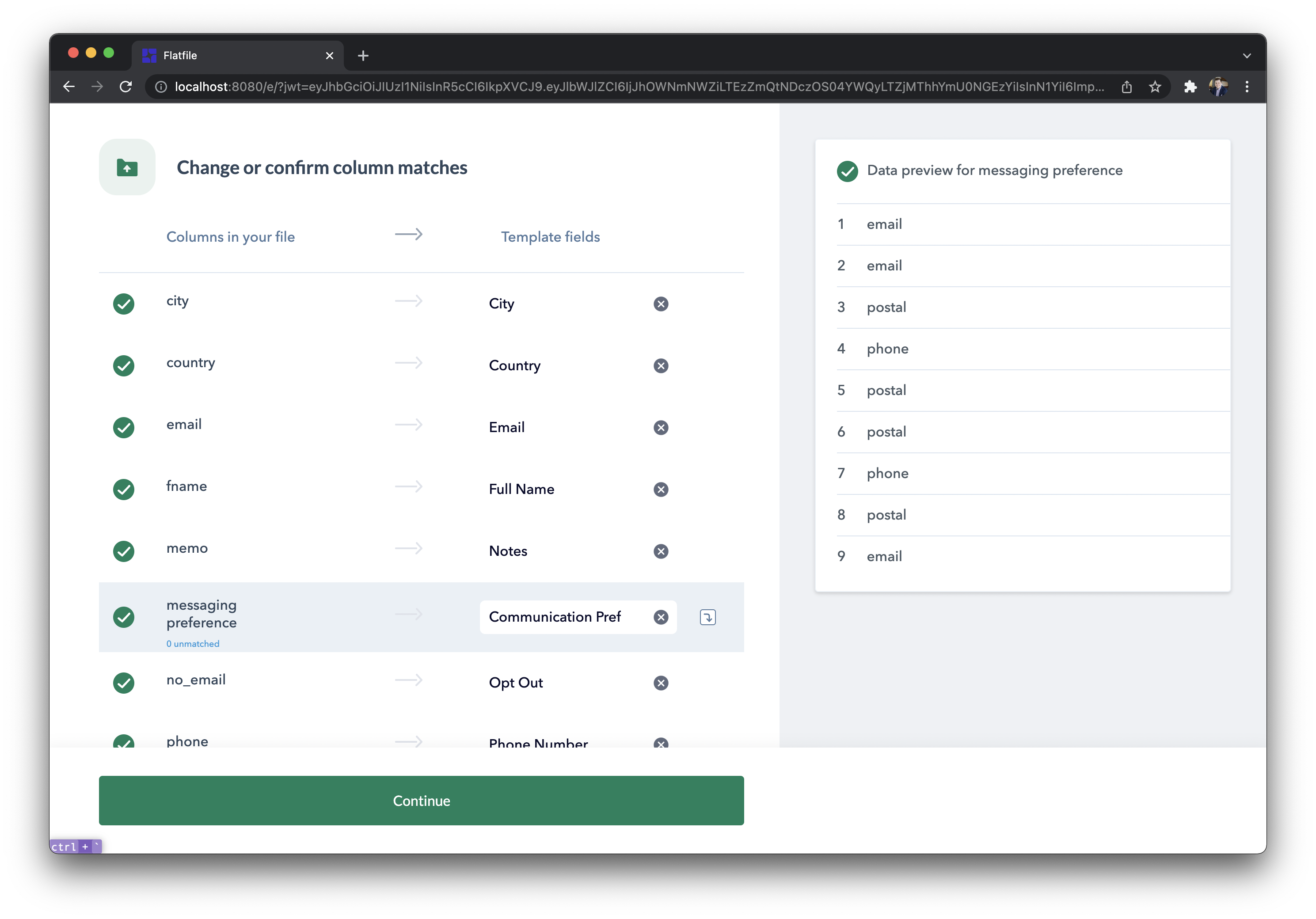

Image Credits: Flatfile

Flatfile uses AI trained on over 25 billion “data decisions” to map and resolve schema with files such as spreadsheets and CSVs. When the algorithms encounter an anomaly or a data type they can’t process automatically, they prompt customers to make a decision and then add that scenario to a database for future reference.

Flatfile recently released a software development kit that will allow developers to build on top of Flatfile’s components to access import, match, merge and export functions. While the company continues to offer an out-of-the-box import workflow, the kit enables customers with more specific requirements to customize the experience, Boskovic said.

“It’s basically letting our customers get under the hood, allowing them to stitch together all the pieces required to move information between systems with maximum flexibility and at scale,” he added. “[The] platform enables companies to leverage their data sooner. It allows employees to focus on their core strengths and leave the dirty work to us. By eliminating the thousands of hours that companies consume ensuring that data is properly formatted for their system, Flatfile helps them get their products to market faster and at a substantial cost savings.”

Flatfile competes with incumbents like Textract, Amazon’s service that can automatically extract text and data from scanned documents, and Microsoft’s data onboarding tool Form Recognizer. Google offers its own data-extracting tools including Cloud Natural Language, which performs syntax, sentiment and entity analysis on existing files.

In any case, Boskovic says that the pandemic and economic downturn were huge growth opportunities for Flatfile — the pandemic because it led companies to migrate data to the cloud and the downturn because it put pressure on them to “prove their value faster.” Flatfile’s customer base stands at thousands of developers and 500 companies as well as several unnamed government organizations.

“Flatfile is in a strong position because it offers a comprehensive solution to a business critical challenge. While we had two years of runway left, we raised an opportunistic Series B to maximize on investor demand, [and now] we have four years of runway to continue improving our operations around customer feedback,” Boskovic said. “This investment will be used to expand and support Flatfile’s fastest growing segment: global enterprise companies. We have been rapidly growing over the last three quarters to reach about 75 employees, and we expect to continue this growth into the near future. Annual recurring revenue is over $5 million, and we project it will more than double over the next 12 months.”

[ad_2]